הקמת נאמנות – איננה תכנון מס "יצירתי"?

אלון קפלן | התפרסם בכלכליסט

נאמנות ככלי משפטי חשוב בתכנון החזקה, ניהול והעברה של נכסי משפחה

בידיעה שהתפרסמה ב"כלכליסט" היתה כותרת: "תכנון מס יצירתי". בכתבה התייחס העיתונאי לפעולתו של דודי עזרא בהקמת נאמנות והועלתה הסברה כי המהלך של הקמת הנאמנות היה לחמוק ממס ירושה עתידי. לא ידוע מדוע נאמרו דברים אלה ואם אכן זאת היתה המטרה בהקמת הנאמנות המדוברת. נאמנות איננה "מכשיר לתכנון מס" – כפי שצויין בכתבה, מיסוי נאמנות איננו שונה ממיסוי רווחים של יחיד. נאמנות היא מבנה משפטי המעוגן בחוק הנאמנות משנת 1979 והיא מוקמת למגוון מטרות להסדרת נכסים של בני משפחה.

להלן נסקור כמה מטרות חשובות להקמת נאמנות.

1. ארגון ניהול עסק משפחתי והעברה בין-דורית של הבעלות והשליטה בעסק

עסק משפחתי מנוהל בדרך כלל בידי מייסד העסק ("היוצר") אשר משתדל לשלב את בני המשפחה שלו.

העברה בין דורית של בעלות בעסק משפחתי שאיננה מתקיימת במשך חייו של היוצר תעשה בדרך של הורשה והליכי ירשוה בבית משפט. כאשר יש ענין למנוע סכסוכי ירושה ניתן להקים נאמנות בחייו של היוצר אשר תוכל להסדיר את ניהול העסק בידי בני המשפחה המעורבים בניהול עו"ד בימי חייו של היוצר וגם לאחר פטירתו.

2. העברה בין דורית של נכסי המשפחה

לעיתים אדם מבקש לדאוג לא רק לילדיו אלא גם לנכדיו או ניניו. נאמנות היא כלי שימושי להעברה בין דורית. כאשר אדם מוריש את רכושו על פי צוואה הוא רשאי להורות כי לאחר מות ילדיו יעבור הרכוש הנותר לידי נכדיו אולם הוא אינו יכול לוודא כי אכן נותר רכוש כזה ולמעשה צורה כזו של העברה היא לרוב יותר משאלת לב שקשה לממש אותה. העברת רכוש לנאמנות ומתן הנחיות לגבי היקף הכספים שיקבל כל דור ודור יכולה להבטיח מחד אורח חיים מכובד לנהנים השייכים לדור השני אך גם שימור של קרן מספיקה על מנת להבטיח אורח חיים רצוי לדורות הבאים.

- Published in בלוג

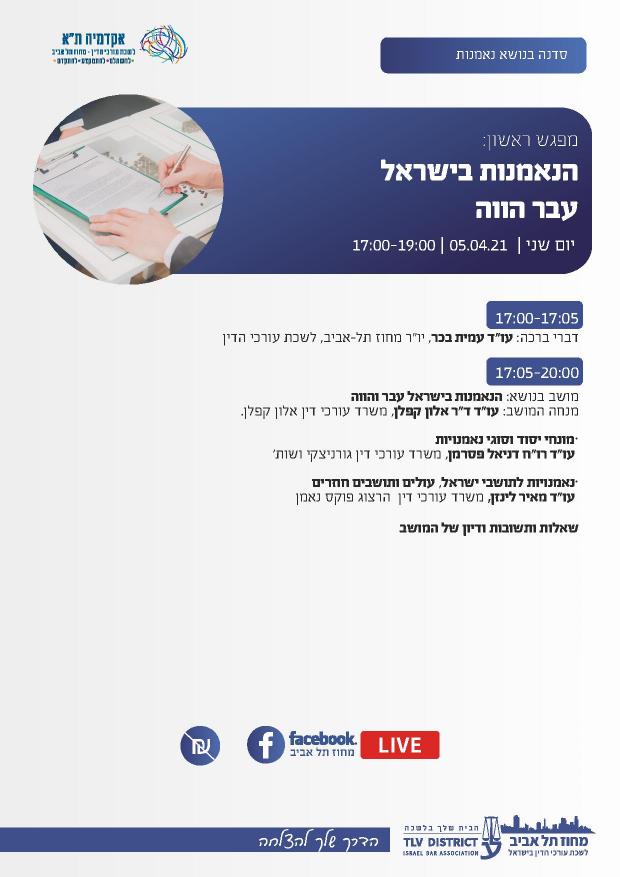

מחוז תל אביב – לשכת עורכי הדין בישראל מושב בנושא הנאמנות בישראל עבר והווה מנחה המושב: עו"ד אלון קפלן, משרד עורכי דין אלון קפלן מונחי יסוד וסוגי נאמנויות – עו"ד רו"ח דניאל פסרמן, משרד עורכי דין גורניצקי ושות' עו״ד רו״ח ענבר ברק-בילו, משרד עורכי דין גורניצקי ושות' נאמנויות לתושבי ישראל, עולים ותושבים חוזרים – עו"ד מאיר לינזן, משרד עורכי דין הרצוג פוקס נאמן

- Published in בלוג

הספר "נאמנות בישראל: הלכה למעשה" יוצא לאור החודש!

הספר נכתב ע"י ד"ר אלון קפלן, ונערך ע"י מיטל ליברמן, שאף השתתפה בו גם כמחברת אורחת.

הספר מבוסס על עבודת המחקר של המחבר, ד"ר אלון קפלן, שהוכנה במסגרת לימודי הדוקטורט שלו באוניברסיטת ציריך, והוא מצטרף למחקרים וספרים נוספים שנכתבו בהשתתפותו של המחבר בשפה האנגלית, לרבות Trusts in Prime Jurisdictions בעריכת המחבר, אשר פורסם בשנת 2016.

הספר מהווה מדריך מקצועי המספק מידע הדרוש לעוסקים בנאמנויות, תכנון נכסי משפחה והעברת בין-דורית של נכסים בישראל של היום. ד"ר קפלן מציג בפני הקורא תמונה מקיפה של מוסד הנאמנות, תובנות לגבי אופן השימוש במוסד זה היום לאור הרקע ההיסטורי, התרבותי והמשפטי שלו. הצגת מוסד הנאמנות בישראל תאפשר להכיר, בין היתר, את הנושאים הבאים: טרמינולוגיה בסיסית ומושגי יסוד בתחום הנאמנות, הדרכים השונות בהן ניתן להקים נאמנות בישראל – על פי חוק, על פי חוזה ועל פי כתב הקדש, נאמנות וירושה, נאמנות ושליחות, מיסוי נאמנויות, נאמנויות לצרכי צדקה, נאמנויות להחזקת נדל"ן, הפרוטקטור ומעמדו בנאמנות, חיסיון וסודיות בנאמנות, נאמנות ובוררות, ה"פמילי אופיס", הנאמנות הבינלאומית והנאמנות ומשפט בינלאומי פרטי.

ד"ר אלון קפלן הוא ד"ר למשפטים מאוניברסיטת ציריך, הוא חבר לשכות עורכי דין בישראל בפרנקפורט ובניו יורק, וכן הוא הנשיא והמייסד של אגודת הנאמנים "Step Israel", המהווה חלק מארגון הבינלאומי STEP.

מיטל ליברמן, עו"ד, היא בוגרת הפקולטה למשפטים של אוניברסיטת בר-אילן משנת 2012 (LLB), ומוסמכת הפקולטה למשפטים של אוניברסיטת תל אביב משנת 2015 (LLM).מיטל חברה בארגון הבינלאומי STEP, וזאת לאחר שהשלימה שנתיים של לימודים והוענקה לה דיפלומה בניהול נאמנויות בינלאומיות.

- Published in בלוג

The Blind Trust

Published in STEP Journal in February 2013

The issue of blind trusts has recently been placed on the Israeli public agenda by Prime Minister Benjamin Netanyahu when he requested permission of the Authorisations Committee of the Israel Securities Authority to make several changes to the makeup of his investment portfolio. The issue of blind trusts has also been discussed in the US with respect to the many assets held by unsuccessful presidential candidate Mitt Romney outside US borders. US media have suggested that such a blind trust is a deception, as the role of trustee is held by Mitt Romney’s personal attorney. The reasoning behind a blind trust, of course, is to prevent situations that may cause a conflict of interest for politicians regarding management of assets in their possession upon assuming elected position.

The blind trust legislation was enacted initially in the US Ethics in Government Act of 1978. The Act does not use the term ‘blind trust’ specifically, yet it creates a legal structure commonly known as a blind trust. According to the Act, among the requirements for a state official to hold assets are: the trustees must be independent of the official, the trust must be free of restrictions on sale or transfer of assets, and the official is to receive no information except for quarterly updates on cash value and income or loss, which is needed for filing income tax returns.

In Israel the blind trust is regulated by the Notice of Rules to Prevent Conflicts of Interest by Ministers and Deputy Ministers of 2003 (the Notice), enacted following the conclusions of the Usher Committee. Section 16 of the Notice provides:

‘(a) Within 60 days of his appointment, the minister shall transfer the funds and securities owned by him and his family members to a public and independent trust company, which shall hold and manage them in a “blind trust”.

‘(b) The Minister and his family members shall not provide the trust company with any instructions regarding which securities to hold and which securities to sell or purchase, except for a one-time instruction, prior to the commencement of providing the service, regarding the types of portfolio investment, and regarding the maximum amount of each type in relation to the value of the portfolio, or instruction that those shall be determined at the trust company’s discretion.

‘(c) The trust company shall not provide the minister and his family members with any information regarding deals in the securities as long as the official holds office; the only information to be provided shall be the total value of the securities, the realised gains, and the tax paid as a result of these gains.’

The Notice does not define the meaning of ‘blind trust’, yet it places the phrase in quotation marks in the section quoted above. An examination of other legislation suggests that the term ‘blind trust’ is not defined in Israeli law at all, and it can be concluded that the term is not referring to a trust as defined in the Trust Law of 1979. This conclusion derives from a closer inspection of the Trust Law of 1979, and of the Agency Law of 1965.

Section 1(a) of the Agency Law provides: ‘Agency is the grant of power to an agent to perform – in the principal’s name or in his place – a lawful act in respect of a third party,’ whereas s2 provides: ‘A person’s agent has the same status as the person himself, and an act of the agent, including his knowledge and intent, binds or entitles the principal, as the case may be.’ It can thus be inferred that the agency cannot place restrictions on the principal with respect to their assets. Furthermore, according to s14, the agency terminates upon its cancellation by the principal or the agent, or upon the death of any of them. Hence, upon the death of the principal, those assets that are held by the agent can be transferred to their new rightful owner only by a probate order.

The Agency Law also enforces a loyalty fiduciary on the agent, as stipulated in s8: ‘When a person has taken upon himself to be an agent, he shall act in a fiduciary capacity to the principal and shall act in accordance with his instructions…’ In Hebrew, the terms ‘fiduciary’ and ‘trust’ are both translated as ‘ne’emanut’. This might explain the use of the word ‘trust’ in the term ‘blind trust’. In fact, in Israel, the ‘blind trust’ is a temporary agency settlement, valid as long as the official holds office, and terminated upon the official’s release from duty. Should the official die while still in office, the Succession Law applies to the blind trust’s assets, and a court ruling would be necessary to distribute the assets to the deceased official’s successors.

The Trust Law creates a completely different structure from the agency, as s1 provides: ‘A trust is a relationship to any property, by virtue of which the trustee is bound to hold the same or to act in respect thereof in the interest of a beneficiary or for some other purpose.’ Section 2 stipulates: ‘A trust is created by law, by a contract with a trustee or by an instrument of endowment.’ Unlike an agency, once a trust is created, its administration, and occasionally its ownership, is transferred exclusively to the trustee in accordance with the trust purposes. This signifies that the settlor’s control over the trust assets is taken from them upon establishing the trust, and, at the time of death, the trust assets are not considered to be among the estate assets – a succession procedure in court is not required for their distribution.

It is clear from the spirit of the rules that the intention is to separate the elected official from assets and from the portfolio manager for the term of office. Once the elected official’s term comes to an end, the assets will be returned to their owner, and the ‘blind trust’ will be terminated. Furthermore, should the official pass away before the end of their term, the ‘blind trust’s’ assets cannot be transferred back to their family without an inheritance procedure, such as a probate order. This outcome is in line with section 14 of the Agency Law, as mentioned above, and it shows that the connection between the official and the assets is not completely severed by the ‘blind trust’.

Based on the above it can be inferred that, despite the terminology, which suggests this structure is a form of a trust, it is not in fact a trust, but an agency/fiduciary relationship.

- Published in בלוג

נאמנויות וירושות בישראל (אנגלית)

Dr Alon Kaplan,TEP

Introduction

- Israel has been ‘home’ for many international families with a connection to the country both from an emotional “sense of belonging” as well as from a financial perspective “the start-up Nation” and involvement of international large companies such as Intel, Google Apple and Facebook.

These sentiments make and maintain Israel a preferable investment jurisdiction, mainly in the banking, private equity High tech technology and real estate areas.

- Non-residents have enjoyed various advantages for holding assets in Israel over the years, mainly in the tax arena, some of which, but not all, remain valid today. Substantial foreign funds have been invested in the Israeli markets.

- Worldwide financial markets and centers have evolved following legislation such as FATCA and CRS. Israel, as a member of the OECD has not remained behind. Nonetheless, in a democracy with a modern and developed independent legal system based on Anglo principles, a globally oriented economy and high-tech industry, a highly professional judicial system, internationally renowned and experienced professionals, it still remains an investment hub.

- International families in the modern era of globalization and movement of people and assets require adequate planning for the holding of assets, investments, cross generational transfer of assets, cross generational business managements transfers and similar areas.

Israel’s relevant legislation, including without limitation, the Agency Law 1965, the Gift Law 1968, the Inheritance Law 1965 (the “Inheritance Law”), the Trust Law 1979 (the “Trust Law”), the Tax Ordinance [New Version], Contract Law 1973 (“Contract Law”) may govern activities and planning by non- residents in Israel.

While criticized in a number of jurisdictions (usually for the wrong reasons), trusts remain a legitimate planning option for various international families and cross border issues in Israel. Israel’s Trust Law governs the establishment of a trust similar to the English trusts, increasingly popular among non-residents.

- The trust institution has been recognized within the territory as early as the1920s, when Jewish families residing in the territory held real property in trust structures under the Muslim Waqf, prior to the foundation of the State of Israel in 1948.

During the British Mandate, 1922-1948, the first trust law was legislated relating to public charities and was based on the common law trust. During these years, private trusts were utilized by Zionist organizations and Jewish families from Europe, United States and Canada as these were jurisdictions in which individuals were familiar with the trust regime. Most professionals in Israel during these years were educated in England and were familiar with English common law principles.

- Following the establishment of the State in 1948, precedents were established in the field of trusts and in 1979 the Trust Law was legislated, and is valid to date. Court precedents have been established over the years in the areas of inheritance, gifts and trusts.

When finally enacted, the Trust Law featured several innovations. Three of these created interesting practical possibilities: the Trust Law allowed the creation of trusts without the settlor transferring full legal title of the trust assets to the trustee; it set no limit whatsoever to the duration of trusts; it permitted non-charitable purpose trusts;

Many Israeli practitioners chose to create for their Israeli and non-resident clients trusts under foreign trust regimes and such trusts are recognized in Israel.

- 7. As a general rule, trusts governed by the Trust Law may be settled by contract or by deed. Trusts settled by contract are governed by the agreement which does not require a written agreement (although proving the terms of the trust may be difficult where there is no written agreement). Contractual trusts do not permit generational transfer of assets upon the settlor’s demise as they do not satisfy the Inheritance Law requirements for the transfer of assets upon death and probate/inheritance proceedings are required for the transfer of the assets to the settlor’s heirs.

Trusts created by deed (known as ‘Hekdesh’ under the Trust Law) require a written Trust Deed signed before an Israeli notary. The trust is established upon the trustee obtaining control of the trust assets. The Trust, upon settlement and management in accordance with the legal requirements, removes the assets from the settlor’s estate therefore not requiring probate or inheritance proceedings upon the settlor’s demise.

Testamentary trusts may be settled within an individual’s last will and testament. Such trusts must be in writing, executed in accordance with the legal formalities required by the Inheritance Law and is valid upon the issuance of a probate court order by an Israeli court.

Conclusion

This introduction to the Trust Law in Israel may lead readers to look for more information about Trusts in Israel.

The book “Trusts in Israel: Development and current practice” was the subject of my dissertation for the PhD at Zurich University. It was published in a limited edition in 2015 by Helbing Lichtenhahn Verlag ,Basel.

A revised new edition under the title “Israel Trust and Estate Law” will be published in New York by Juris Publishing in the fall of 2016.

- Published in בלוג