Alon Kaplan and Meytal Liberman

Abstract – How to use a trust as an alternative to a will to transfer assets to the next generation? This article will answer this question by first introducing the reader to inheritance and trust law in Israel. It will explore the endowment and how it should be used in order to regulate the transfer of assets to the next generation—how a trust should be set up and how assets should be transferred to it. The conclusion drawn from this analysis points out the key elements which should be considered when creating a trust to survive death under Israeli law

- Published in Articles

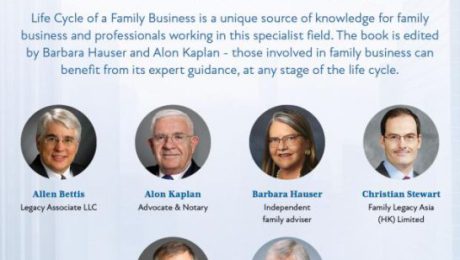

Pleased to invite you to a virtual launch event of the book: Life Cycle of Family Businesses 17th March

2021 – 11:00 am EDT, 17:00 Tel Aviv

Zoom Link

- Published in Blog, Business, Citizenship, Company, corporation, Estate, Estate planning, Family office, Foundation, Gift, Hekdesh

The Israeli Trust

Published in STEP Trust Quarterly Review Volume 17, Issue 2 2019

Dr. Alon Kaplan and Meytal Liberman

ABSTRACT

• Israel’s trust law applies to any trust relationship; however, the main route to create a private trust is by creating a hekdesh, also known as an endowment. The hekdesh is a document signed unilaterally by the settlor and can be executed either before a notary or as a last will and testament.

• Since a trust under Israeli law, including a hekdesh, is not considered a legal entity, common practice is to use an underlying company to hold the trust assets. The use of a hekdesh combined with an underlying company offers an efficient instrument for estate planning, contrary to a trust created by a contract between the settlor and the trustee.

• This article will review the trust under Israeli law, with an emphasis on the hekdesh and its use. It will also investigate the recognition of foreign trusts under Israeli law.

- Published in Articles

Alon Kaplan

Books – Contribution of chapters on Israel

- Published in Articles